Fl Veteran Drivers License

The state of Florida provides several veteran benefits. This section offers a brief description of each of the following benefits. Hawker Siddeley Hs 748 Pdf Writer there. • • • • • • Florida Veteran Housing Benefits Florida State Veterans' Homes Program The Robert Jenkins, Jr. Assisted Living/Domiciliary Home is a 149-bed Assisted Living Facility in Lake City that provides a special combination of housing, personalized supportive services, and incidental medical care to eligible veterans. Domiciliary care is provided to veterans discharged under honorable conditions. Veterans admitted must be residents of Florida for one year prior to admission.

Matteo Tarantino Disco Grafia Torrent. The Military Gold Sportsman's License is available at tax collectors' offices only. Applicants must present a current military ID card plus a Florida driver's license or orders showing they are stationed in Florida as proof of eligibility. 100% permanently and totally disabled service-connected veterans are entitled to a free five.

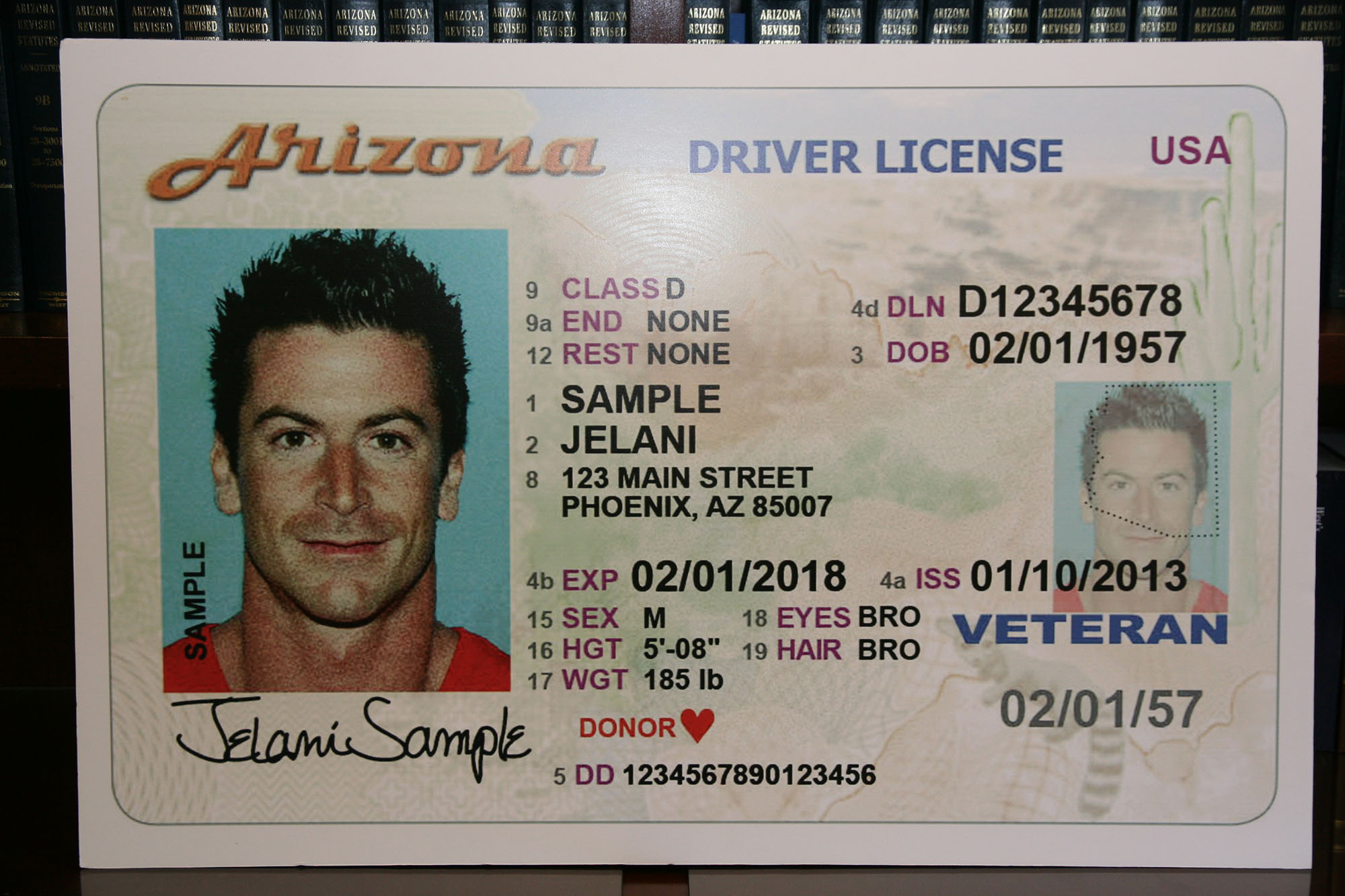

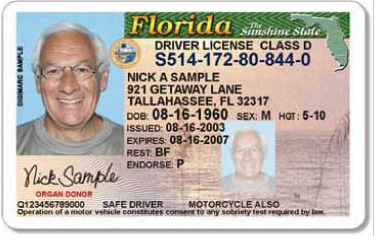

Driver's License & ID Cards. Veterans who live in the Sunshine State can add a veteran designation to their driver license or ID card, which is simply a blue “V” on the bottom right portion of the card. To add the “V” to a license or ID card, veterans can visit any Florida driver license office, or your local Tax Collector's Office. Hunting and Fishing License Active-duty and retired military Florida residents can get a Military Gold Sportsman's License for $20. The license covers hunting, freshwater and saltwater fishing and a variety of associated permits at a greatly reduced cost. The Military Gold Sportsman's License is available at tax collectors' offices only.

The cost of care is determined based on income.. Veterans' Nursing Homes of Florida The state of Florida operates 6 Veterans' nursing homes and 1 assisted living facility throughout the state.

Basic admission requirements for all veterans' nursing homes in Florida include an honorable discharge, Florida residency for one year prior to admission, and certification of need of nursing home care by a VA physician. Florida Veteran Financial Benefits Basic Property Tax Exemptions Eligible resident Veterans with VA certified service-connected disability of 10% or greater shall be entitled to a $5,000 property tax exemption. The Veteran must establish the exemption with the county tax official by providing documentation of their disability. The unremarried surviving spouse, who on the disabled ex-service member's death had been married to the ex-service member for at least 5 years is also entitled to this exemption. Homestead Exemption Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service-connected, permanent and total disability, is exempt from taxation if the veteran is a permanent resident of Florida and has legal title to the property on January 1 of the tax year for which exemption is being claimed.